Australia’s wealthiest woman, Gina Rinehart, continues to bolster her global mining footprint with a strategic investment in a copper and gold project in Ecuador. Hancock Prospecting has entered into an agreement with Titan Minerals, paving the...

Latest

Most Read

Receive our free daily newsletter:

Sponsored Posts

Latest News

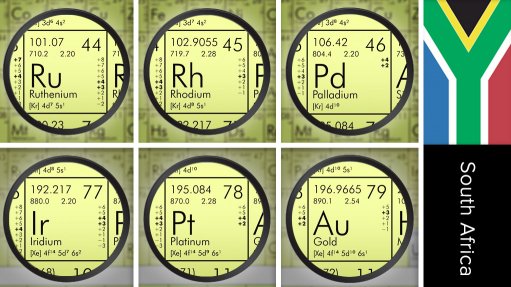

South Africa will use future drawdowns of its Gold and Foreign Exchange Contingency Reserve Account to curb its debt burden, Finance Minister Enoch Godongwana said, adding he was pondering tax...

Saudi Arabia is moving closer to a potential deal to acquire a minority stake in a Pakistan mine controlled by Barrick Gold, people with knowledge of the matter said. Manara Minerals Investment,...

ASX-listed Challenger Gold has placed an additional A$4-million to a single investor at 8.5c a share for an one-for-one option exercisable at 14c a share. The investor approached the company and...

ASX-listed Spartan Resources on Thursday unveiled an A$80-million fully underwritten equity raising to accelerate exploration and development of the Dalgaranga gold project, in the Murchison...

Building upon the momentum of 2022’s surge in silver consumption for industrial applications, 2023 saw yet more record-breaking industrial demand, reaching 654.4-million ounces, fuelled by the...

Toronto-listed Solaris Resources and the Shuar communities of Warints and Yawi have signed an updated impact and benefits agreement (IBA), reflecting the evolving growth and development of the...

Police have named Air Canada employees among the suspects in the theft of 6 600 gold bars from a cargo facility at the country’s busiest airport, in what’s been dubbed Canada’s largest-ever gold...

Sponsored Posts

Latest News

Aim- and ASX-listed Jubilee Metals has achieved record production levels at its South African chrome operations, both on monthly output for March and for the quarter ended March 31 – which is the...

JSE- and ASX-listed Orion Minerals has requested an immediate trading halt to be placed on its securities, pending the release of an announcement in relation to exploration results at its Okiep...

Diversified mining company BHP is nearing a decision regarding its nickel operations in Western Australia. The company, which has been conducting a review of these assets since February, is...

Aurubis, Europe's largest copper producer, plans to eschew large acquisitions and instead build a network of recycling facilities across the globe as part of its focus on organic growth, its CEO...

Australian oil and gas producer Santos said on Thursday its first-quarter revenue fell about 14%, hurt by lower production across its product portfolio and a decline in volumes in recent months....

African technology innovator Sedna Industrial IT Solutions has partnered with video networking and visual collaboration solutions provider Haivision to bring industrial and mining command control...

Standard Bank head of Southern Africa’s oil and gas coverage Paul Eardley-Taylor has suggested that South Africa needs 13 GW of gas-to-power (GtP) capacity, rather than the 7.2 GW to 8.6 GW...

Sponsored Posts

Latest News

Minerals Council South Africa is focused on increasing the domestic demand for green hydrogen, which it sees as contributing to the kickstarting of the hydrogen economy in South Africa. “The...

This week: Use underground mines for electricity storage, optimise mine water use; Market development of full PGMs basket is essential, Industry Day hears, and, South Africa well placed to benefit...

Mining and trading house Glencore aims to take thousands of metric tons of Russian aluminium from the London Metal Exchange (LME) and return it at a later date to profit from rule changes, three...

Zambia’s State power utility has served notices of force majeure on supply of electricity to some mines, according to an industry association, threatening additional pressure on a copper market...

ASX-listed unhedged gold mining company West African Resources has reported high-grade gold mineralisation from recent infill underground diamond drilling within the main lode at the M1 South (M1S)...

ASX-listed Lotus Resources has developed a detailed initial programme of work to maximise the potential of its Letlhakane uranium project, in Botswana. The company is working to update the...

AQSE-listed Marula Mining is progressing mining and processing activities at the Larisoro manganese mine, located in Samburu County, in northern Kenya. As announced last month, the company has...

A video round up of this week’s magazine, highlighting our cover story, features and Business Leader.

Deutsche Post’s last night flights transporting mail between northern and southern Germany took place in the early hours of March 28, ending a near 63-year airmail service that had operated since...

- Engineering News Features

- Generators & Standby Power

- Working at Height

- Mining Weekly Features

- Manganese

- Mining in Tanzania

Gauteng’s Far West Rand mining-linked area has always had excellent agricultural potential. In fact, the area had all the makings of a colossal market garden had early mining not dewatered the...

It is estimated that about 2.5 GW of rooftop solar was installed across South Africa last year; a trend that was expected to continue at the start of this year given that some 5 GW of solar panels...

Business Leader

This week we profile Renier van Rooyen, group business systems executive at Multotec, a supplier of mineral processing equipment

While voters will receive three quite different looking ballots on May 29, this seeming increase in choice is not necessarily translating into greater excitement. Yes, some independents will...

Popular This Week

Latest Multimedia

Research Reports

Projects

Showroom

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation