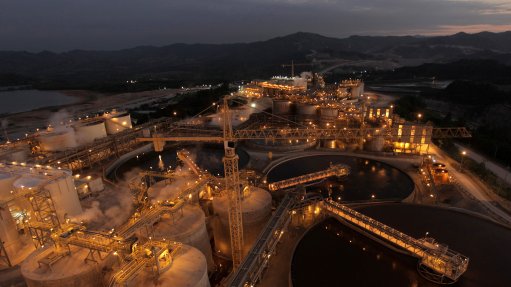

Rio Tinto aims to keep all of the copper from its Resolution mine inside the United States should the long-delayed and controversial project win regulatory approval, a senior executive said on Tuesday. The Arizona mine would, if developed, over...

Latest

Most Read

Receive our free daily newsletter:

Sponsored Posts

SPONSORED POST

Latest News

A local court in Brazil has again suspended the operating license for Vale's Brazilian Sossego copper mine, the company and the country's Para state said. The state won an appeal overturning a...

Peru's copper production grew 12.7% in February to reach 216 752 metric tons, the country's energy and mining ministry said on Tuesday. Peru is one of the world's top producers of copper, and...

Rio Tinto Group’s copper head says he sees much more value in building mines rather than buying existing assets — comments that may disappoint industry observers anticipating another spate of...

When the group of mining executives arrived at Panama’s regal Palacio de las Garzas, they were ushered past the ornate, wood-paneled ceremonial rooms and straight to the private office of the...

Project developer Western Copper and Gold has upsized its bought-deal public offering to fund permitting and engineering work at its Casino project, in Yukon, to $40-million. The TSX- and NYSE...

Chile's State-run miner Codelco has made progress in negotiating with local communities over lithium mining and will keep working to win their support, CEO Ruben Alvarado said on Tuesday, a day...

Endeavour Mining has been accused by Lilium Mining of misrepresentation over the sale of two African gold mines, as the fallout from the tenure of ousted CEO Sebastien de Montessus continues....

Sponsored Posts

Latest News

Coal miner Peabody is developing a 130-million-ton, 25-year-plus mine plan for the Centurion complex, in the Bowen basin of Queensland. The mine plan incorporates the newly acquired Wards Well...

In order to fill a potential supply gap of eight-million tons by 2034, mining companies need prices that are higher than $10 000/t and possibly as high as $12 000/t, says Trafigura Group CEO Jeremy...

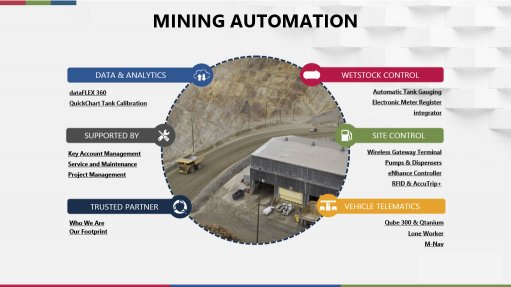

African technology innovator Sedna Industrial IT Solutions has partnered with video networking and visual collaboration solutions provider Haivision to bring industrial and mining command control...

Standard Bank head of Southern Africa’s oil and gas coverage Paul Eardley-Taylor has suggested that South Africa needs 13 GW of gas-to-power (GtP) capacity, rather than the 7.2 GW to 8.6 GW...

Minerals Council South Africa is focused on increasing the domestic demand for green hydrogen, which it sees as contributing to the kickstarting of the hydrogen economy in South Africa. “The...

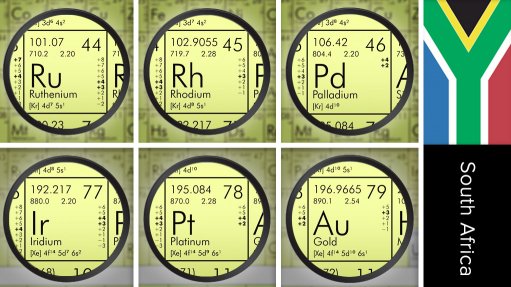

This week: Use underground mines for electricity storage, optimise mine water use; Market development of full PGMs basket is essential, Industry Day hears, and, South Africa well placed to benefit...

Mining and trading house Glencore aims to take thousands of metric tons of Russian aluminium from the London Metal Exchange (LME) and return it at a later date to profit from rule changes, three...

Sponsored Posts

Latest News

Zambia’s State power utility has served notices of force majeure on supply of electricity to some mines, according to an industry association, threatening additional pressure on a copper market...

ASX-listed unhedged gold mining company West African Resources has reported high-grade gold mineralisation from recent infill underground diamond drilling within the main lode at the M1 South (M1S)...

ASX-listed Lotus Resources has developed a detailed initial programme of work to maximise the potential of its Letlhakane uranium project, in Botswana. The company is working to update the...

AQSE-listed Marula Mining is progressing mining and processing activities at the Larisoro manganese mine, located in Samburu County, in northern Kenya. As announced last month, the company has...

Australia-headquartered Orion Minerals has made progress with acquiring a controlling interest in the Okiep copper project, in South Africa’s Northern Cape province. Orion and other relevant...

Diamond miner De Beers says it generated about $445-million in revenue from its third sales cycle for this year. The figure represents the expected sales value from the company’s latest global...

Australian Prime Minister Anthony Albanese on Wednesday announced the federal government’s support for two critical minerals projects in Queensland and South Australia, a move aimed at fostering...

A video round up of this week’s magazine, highlighting our cover story, features and Business Leader.

Deutsche Post’s last night flights transporting mail between northern and southern Germany took place in the early hours of March 28, ending a near 63-year airmail service that had operated since...

- Engineering News Features

- Generators & Standby Power

- Working at Height

- Mining Weekly Features

- Manganese

- Mining in Tanzania

Gauteng’s Far West Rand mining-linked area has always had excellent agricultural potential. In fact, the area had all the makings of a colossal market garden had early mining not dewatered the...

It is estimated that about 2.5 GW of rooftop solar was installed across South Africa last year; a trend that was expected to continue at the start of this year given that some 5 GW of solar panels...

Business Leader

This week we profile Renier van Rooyen, group business systems executive at Multotec, a supplier of mineral processing equipment

While voters will receive three quite different looking ballots on May 29, this seeming increase in choice is not necessarily translating into greater excitement. Yes, some independents will...

Popular This Week

Latest Multimedia

Research Reports

Projects

Showroom

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation