Copper made a fresh push toward five digits as BHP Group’s blockbuster offer to buy Anglo American lent support to bulls who say the metal is headed for long-term shortages and high prices. The world’s biggest miner has proposed a $39-billion...

Latest

Most Read

Receive our free daily newsletter:

Sponsored Posts

Latest News

China's Tianqi Lithium said on Thursday it has formally requested that a proposed joint venture between lithium company SQM, in which it is a major shareholder, and state-run copper miner Codelco...

Copper miner Antofagasta is holding meetings with investors this week for its first dollar bond offering in nearly two years, people familiar with the matter said. CFO Mauricio Ortiz and other...

When former boss Mark Cutifani left Anglo American in mid-April 2022, things had rarely looked better for the century-old miner. Metals prices soared as the world emerged from lockdowns, the...

On Thursday, BHP Group bid $38.8-billion for smaller rival Anglo American, offering a deal to forge the world's biggest copper miner. Here is a list of some previous big-ticket deals in the mining...

Credit agency Export Development Canada (EDC) has indicated in a conditional letter of interest that it will provide a direct lending debt funding package of up to A$400-million to ASX-listed...

Copper hit $10 000 a ton for the first time in two years as speculation builds that the world’s mines will struggle to meet a coming wave of demand from green industries. The metal reclaimed its...

The growth in demand for platinum applications in China is extremely high, making detailed access to the China market hugely advantageous. Providing this detailed access from July 8 to 11 will be...

Sponsored Posts

Latest News

Activist fund Elliott has built up a $1-billion stake in Anglo American, a filing showed on Friday, after the London-listed miner became a takeover target by bigger rival BHP Group. Elliott...

China is losing its appetite for Russian coal as import taxes and logistical snarls push Asia’s biggest buyer to cheaper alternatives. Russian exports plunged 22% in the first quarter after...

hina's gold consumption in the first quarter of 2024 climbed by 5.94% from a year earlier on soaring safe-haven demand, the country's Gold Association said on Friday. Bullion consumption in the...

JSE-listed Impala Platinum Holdings (Implats) has initiated a Section 189(3) consultation process at its South African operations, signalling thousands of potential job losses. Implats envisages a...

ining and trading house Glencore will invest in Nigeria's mining sector if the government ensures a stable business climate, the company's CEO said on Thursday during a visit to Nigeria's minister...

South Africa-focused coal company MC Mining on Friday announced the resignation of Nhlanhla Nene as director and chairperson of the board. Nene joined the company on April 11, 2022, initially...

The Australian Workers’ Union (AWU) has voiced serious concerns following an incident at Glencore’s copper smelter in Mount Isa, which left two workers in critical condition. “Tough questions need...

Sponsored Posts

Latest News

Mining Weekly Editor Martin Creamer unpacks Copper 360’s shares rising more than 26% after it shipped concentrates from the Northern Cape; Orion Minerals shares rocketing to 58% on the Australian...

JSE-listed Anglo American Platinum (Amplats) has appointed Sayurie Naidoo as CFO and executive director, with effect from May 1. Naidoo, who has been serving as the acting CFO since Craig Miller...

Against the arid, red dirt of the Australian Outback, the Mount Holland lithium mine emerges to approaching visitors as a colossal grey-tinged crater, with trucks the size of houses edging along...

As uranium developer Bannerman Resources progresses with its plans for an initial eight-million-tonne-a-year Etango project, in Namibia, it is casting its gaze towards a broader horizon. The...

BHP Group shares fell 4% on Friday a day after revealing a $38.8-billion bid for Anglo American as investors feared a deal could erode BHP's profitability especially if it has to sweeten its...

Anglo American's management does not consider a proposed $39-billion takeover offer from BHP Group as attractive, two sources told Reuters, as some investors and analysts dismissed it as...

China's Zhaojin Mining Industry has increased its voting power in Tietto Minerals, an exchange filing from the Australian gold miner showed on Friday. Zhaojin Capital, a unit of Zhaojin Mining,...

A video round up of this week’s magazine, highlighting our cover story, features and Business Leader.

Eskom and government are considering private and foreign options to fund a R390-billion expansion of the electricity grid as more renewable generation comes online. Bloomberg reports that talks are...

- Engineering News Features

- Gas

- Metalworking & Fabrication

- Sewage & Effluent

- Mining Weekly Features

- Mandela Mining Precinct

- New Mining Technologies

The potential loss of platinum group metals (PGMs) demand to battery electric vehicles (BEVs) spells dire consequences for the South African mining industry. At risk are income streams to nearly...

Memories are short and it often feels like they are becoming shorter not only because of the flood of information associated with the 24-hour news cycle but also second-by-second social media...

Business Leader

This week we profile Henry Adams, country manager at InterSystems, the primary business of which is supplying and supporting software products

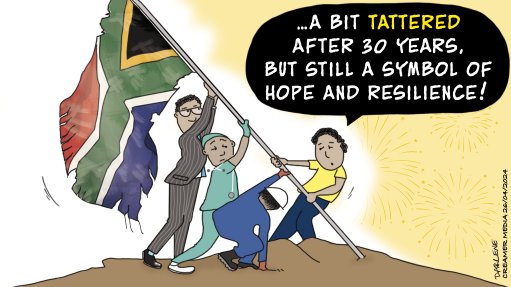

Years of State capture, corruption and ongoing crime and violence have left deep scars and have taken most of the gloss of any celebrations marking 30 years of democracy. Nevertheless, South Africa...

Popular This Week

Latest Multimedia

Research Reports

Projects

Showroom

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation