Canada-headquartered Barrick Gold has announced its preliminary figures for the first quarter of 2024, reporting gold output of 940 000 oz and copper output of 40 000 t. Gold production fell by 12% quarter-on-quarter, which Barrick attributed to...

Latest

Most Read

Receive our free daily newsletter:

Sponsored Posts

SPONSORED POST

Latest News

Australia-listed New World Resources has received firm commitments to raise about A$20.4-million to advance its Antler copper project, in Arizona, US, towards development and production. The...

Low rates of investment in the global mining sector have put the global energy transition at risk, widening the supply gap in critical minerals like copper, Rio Tinto chairman Dominic Barton said...

Rare earths miner Rainbow Rare Earths has revealed that the results of mineralogy and hydrometallurgical testwork recently carried out on phosphogypsum material from the Mosaic Company’s Uberaba...

The four largest indigenous communities in Chile's Atacama salt flat suspended dialogue with state-run copper giant Codelco and lithium miner SQM over expanding lithium mining in the flat, the...

The FBI has opened a criminal investigation into what occurred on the cargo ship that crashed into Baltimore’s Francis Scott Key Bridge and caused it to collapse, according to a person familiar...

North American lithium company Patriot has announced the resignation of Nicholas Vickery as MD, with effect from Tuesday. Vickery is leaving the ASX-listed company a year into the job to take up a...

German coal mines spew 184 times more methane than what the country reports to the United Nations, according to a new analysis by Ember. The energy think tank used methodology developed by...

Sponsored Posts

Latest News

The sale by Southern African diamond mining company Petra Diamonds of an exceptional blue diamond in its fifth tender cycle lifted the average prices per carat received 22% higher than those of the...

Exploration and development company African Pioneer has provided an update on exploration conducted and funded by First Quantum Minerals (FQM) during the six-month period to December 31 over...

Aim-listed gold producer Shanta Gold has revealed “encouraging results” in an exploration update for the West Kenya project, in Kenya, for the fourth quarter of last year and the first quarter of...

The Geological Society of South Africa’s (GSSA’s) Northern Cape branch will host a West Coast Diamonds event and excursion on May 17 and 18, in the Northern Cape. The event will be hosted at the...

In a move to bolster environmental protection measures, Environment Minister Tanya Plibersek announced on Tuesday the establishment of an Environment Protection Agency (EPA) as part of the Albanese...

South Africa has fallen to sixty-ninth from sixty-fourth on the World Energy Council’s (WEC’s) latest World Energy Trilemma Index which ranks more than 100 countries against the three key...

The Chamber of Minerals and Energy of Western Australia (CME) has announced the appointment of Simon Trott as its new president. Trott, currently serving as the CE of Rio Tinto Iron Ore in Western...

Sponsored Posts

Latest News

Aim- and ASX-listed Aura Energy and uranium trader and investor Curzon Uranium have agreed to restructure their uranium offtake agreement, materially increasing the price receivable for planned...

Battery metals miner Marula Mining’s Kenyan representative company has been awarded a mineral dealer’s trading licence, granting it the right to buy, sell and export manganese ores. Marula...

New York- and Toronto-listed Platinum Group Metals, which is emerging in South Africa’s Waterberg, on Tuesday provided an update on its new light battery technology that points to increasing...

China's coal output fell 4.2% in March, statistics bureau data showed on Tuesday, as miners cut back production on lower demand from power generators and ample inventories of the fuel limited...

ASX-listed Sunstone Metals has announced the appointment of former Xstrata Copper executive Neal O’Connor as nonexecutive director. The appointment follows the recent appointment of Patrick Duffy...

Chile has started accepting statements of interest for lithium exploration and aims to develop up to five new projects in the country, the government announced on Monday. Chile is the world's...

Vancouver-based OceanaGold has obtained regulatory approvals for an initial public offering (IPO), which will involve 20% of the outstanding shares of its Philippines subsidiary. The Phillippine...

A video round up of this week’s magazine, highlighting our cover story, features and Business Leader.

Deutsche Post’s last night flights transporting mail between northern and southern Germany took place in the early hours of March 28, ending a near 63-year airmail service that had operated since...

- Engineering News Features

- Generators & Standby Power

- Working at Height

- Mining Weekly Features

- Manganese

- Mining in Tanzania

Gauteng’s Far West Rand mining-linked area has always had excellent agricultural potential. In fact, the area had all the makings of a colossal market garden had early mining not dewatered the...

It is estimated that about 2.5 GW of rooftop solar was installed across South Africa last year; a trend that was expected to continue at the start of this year given that some 5 GW of solar panels...

Business Leader

This week we profile Renier van Rooyen, group business systems executive at Multotec, a supplier of mineral processing equipment

While voters will receive three quite different looking ballots on May 29, this seeming increase in choice is not necessarily translating into greater excitement. Yes, some independents will...

Popular This Week

Latest Multimedia

Research Reports

Projects

Showroom

Press Office

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

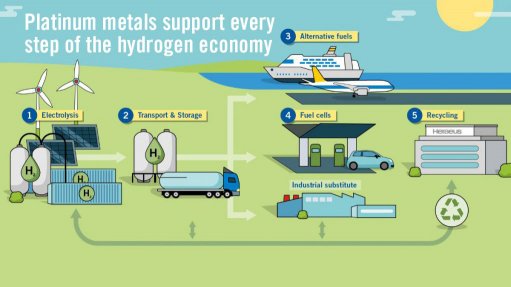

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

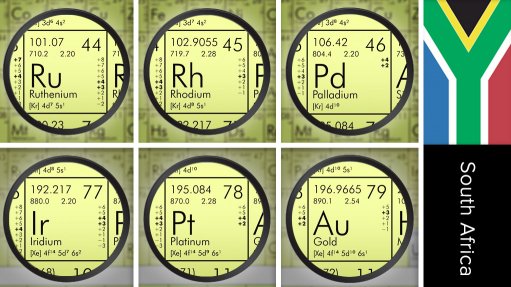

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation